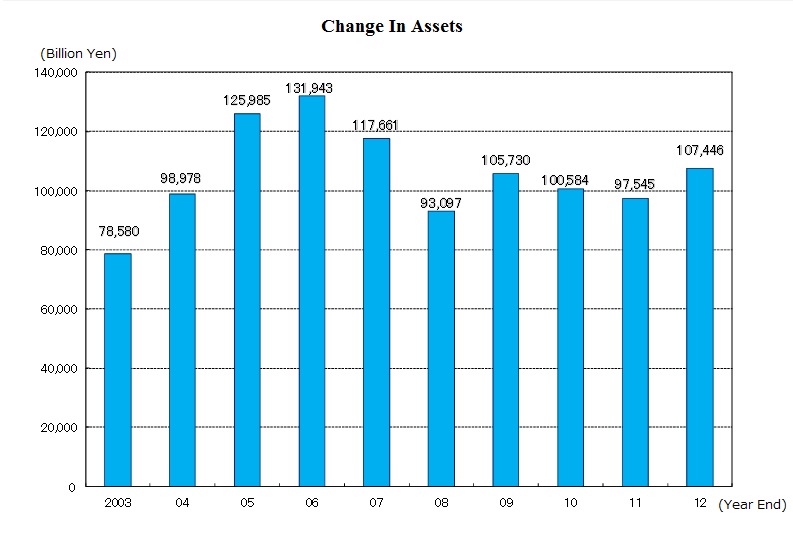

Pension Fund Association is one the largest pension funds in Japan with total of 10.7 Trillion JPY assets under management. PFA invests in domestic and international market using both in-house and external fund managers.

The following report provides guidelines on PFA’s hiring requirements for external fund managers based on their 2012 performance report and general guidelines.

- Asset Allocation Overview

-

In fiscal year 2012 PFA has a total asset of 10.7 Trillion JPY, with a modified total return of 15.43% and time weighted return of 15.88%

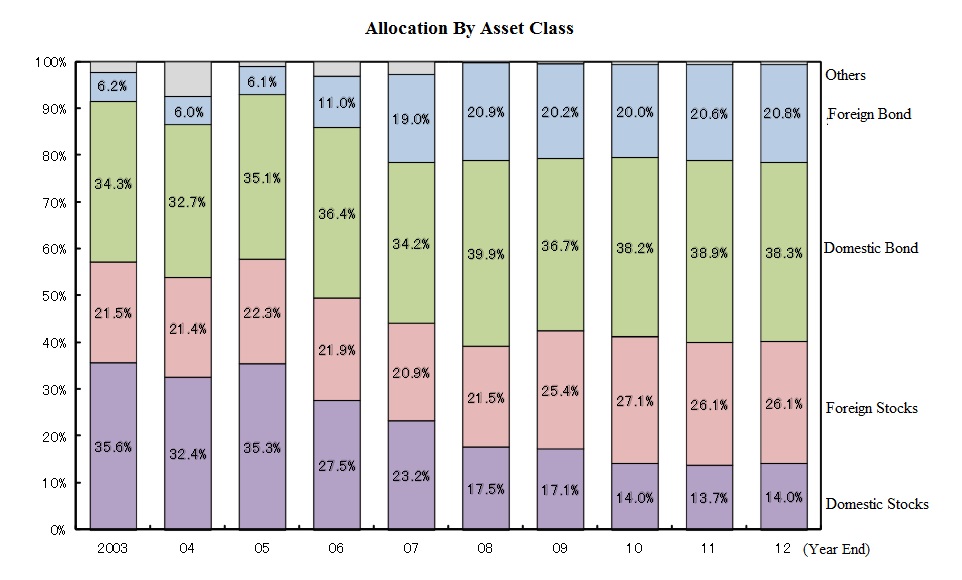

2012's Asset Allocation

Historical Asset AllocationDomestic Equity 14.0% Foreign Equity 26.1% Domestic Bond 38.3% Foreign Bond 20.8% Real Estate&Others 0.8%

- Investment Return Overview

-

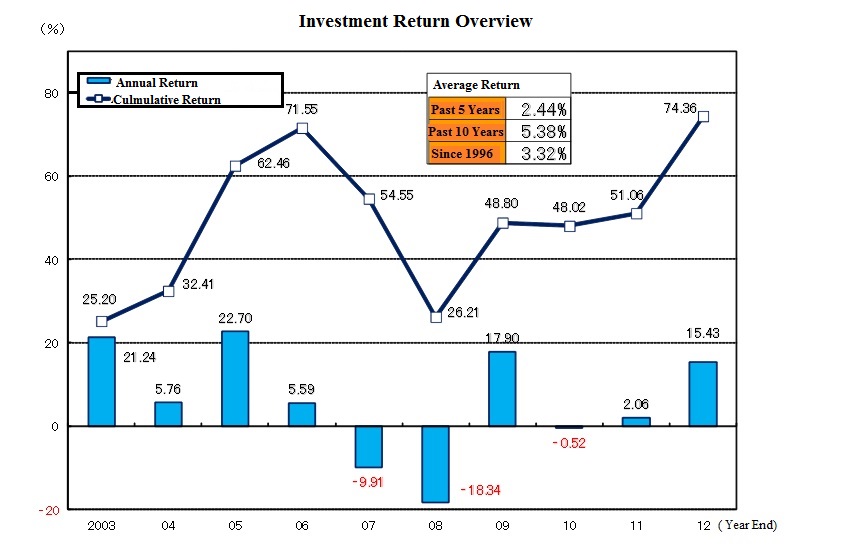

2012 Fiscal Year Total Return:15.43%

Return by AssetDomestic Equity 23.99% Foreign Equity 28.19% Domestic Bond 4.35% Foreign Bond 16.68% * Policy on asset mix result in excess of 0.84% rate of return

*Factors contributed to the excess return:

- Manager selection and off-benchmark affected +1%

- Deflation and Market change: -0.2%

In 1996, asset allocation were abolished and investments were liberalized.

In 1996, asset allocation were abolished and investments were liberalized.From year 2008 and after, temporary fund managers are hired for short-term investment. All investments are recorded in the data, no additional asset investments are made besides the recorded.

- Investment Strategy Overview

-

PFA uses Plan-Do-See cycle as its primary investment process and invest under its policy asset mix and rebalancing strategy; where PFA sets the funding for each asset and rebalancing its investment according to market fluctuation. In 2012, 580 billion JPY worth of shares were sold in 9 times duration from late November to the end of the year. 237 Billion JPY was devoted to the pension benefits while rest were prepared for 2013 investments.

PFA sets policy asset mix for its asset allocation. Factors such as pension asset, liabilities, future cash flow, asset returns and many others were used and reviewed to achieve its goal for the total fund.

*General asset allocation for equities and bonds in accordance with funding level. Allowance of +/-5% shall be admitted.

Funding Level Domestic and Foreign Bonds Domestic and Foreign Equity Less than 100% 57% 43% 100%-less than 105% 62% 38% 105%-less than 110% 67% 33% 110%-less than 115% 75% 25% More than 115% 80% 20%

- Policy in Alternative Assets

-

Hedge Fund:

Investment in hedge fund is classified as the alpha portion of the portable alpha strategy in order to diversify alpha sources. PFA invests within the limit of 4% of the gross asset by an actual investment balance.

Performance:Total investment as in the end of 2012 is 4500Billion JPY. Return for 2012 was +1.5% excess to benchmark.

Strategies:To improve operational efficiency the following strategies are implemented.

- Foreign equity alpha strategy (long-short)- replacement of the fund managers were implemented.

- Foreign bond alpha strategy(event-driven center)

- Risk Management strengthening (same as 2011)- improve transparency on the operation content and improve understanding of overall risk.

Private equity investment is classified as part of equity exposures to capture alpha from long-term illiquidity premiums and from effective governance over companies. PFA invests within 2% gross asset by an actual investment balance. Asset allocation falls under distribution of equities.

Performance:Investment in PE as in the end of 2012 is 1580 billion JPY, new investment amount in the fiscal year is 36 billion JPY and distribution amount is 20 Billion JPY. New commitment of 65 billion JPY is implemented to PE in fiscal 2012.

Strategies:As a continuation in 2011's strategy report from midterm investment planning that focused mainly on oversea single fund, the investment strategy based on surveys from over sea gatekeepers suggested strategies targeting emerging area, buyout on small-medium sized enterprise, sector focused buyouts, regional and more, which are all used for PFA's fund selection for the next few years. In 2012, 7 continuous sectors strategies from the gatekeepers survey were used for fund selection.

Real Estate:

Investment in real estate is classified as an independent asset class separate from traditional asset class for the primary purpose of acquiring long-term income gains (rent etc). PFA invests with the limit of 2% of gross asset by an actual investment balance. Investment in real estate is not included in the policy asset mix and rebalancing.

Performance:As of end of 2012, investment in office building as a central focus raeched 840 Million JPY. 210 Million JPY for new investment is implemented this year in office and residential assets.

Infrastructure:

Investment in infrastructure is classified as part of bond exposures for the primary purpose of acquiring long-term income gains (such as usage fee). PFA invests with in the limit of 2% of gross asset by an actual investment balance.

- Selection and Evaluation of Investment Managers

-

PFA selects investment manager based on a quantitative evaluation on their investment strategy, track records, and performance following the GIPS(Global Investment Performance Standards). Investment managers are evaluated for their mid-long term performance and pre-contract quantitative evaluation regardless of post contract durations. In addition, selected investment managers must report to PFA frequently on their investments or any other changes in the fund including strategy change.

For detailed guideline on PFA's requirement on fund manager's duty, please visit PFA's home site.