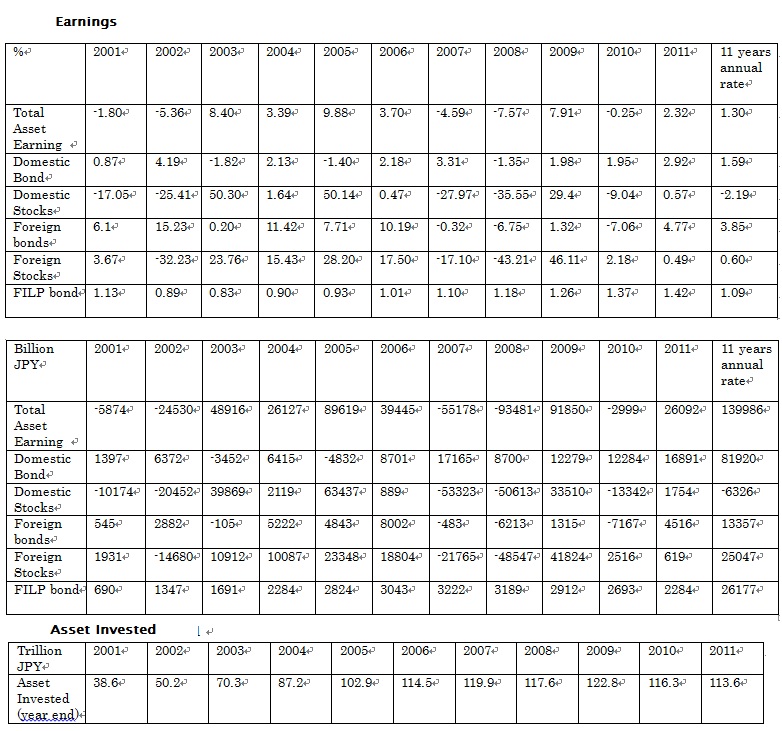

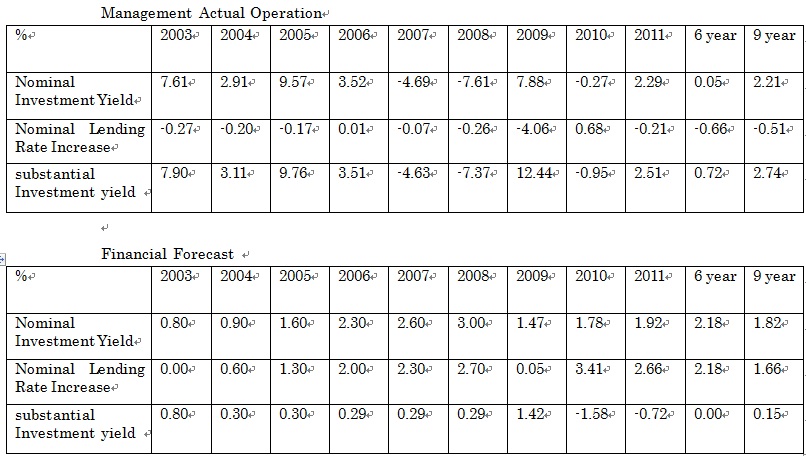

As of quarter 3 of fiscal 2012, GPIF reported an increase in total investment with a 4.83% rate of return, 5,135.2 billion JPY in income, and total asset of 111,929.6 JPY compare to 3rd quarter of 2011’s earning summary. For its market investment break down, we have 5.39% for rate of return, 5,091.8 Billion JPY for income, and 100,655.7 Billion JPY for total asset in the market. On its market investment, domestic stock lead in performance with 16.71% in benchmark return, followed after is foreign stocks with 13.78% in benchmark return, 13.62% for foreign bond, and -0.06% for domestic bond, however, foreign stock had an excess return of +0.04 while others remains zero negative. FILP Bonds has a 0.37% return rate with an invested income of 43.4 Billion JPY and total asset in the FILP bond is 11,273.9 billion JPY.

(For more detailed summary on GPIF’s 2012 quarter 3 earning report please visit http://www.gpif.go.jp, all information are summarized based on official data provided by the GPIF on GPIF homepage)

- GPIF Background History

-

Before the year 2000, Japan’s Minister of Health, Labor and Welfare, who manage the Reserve Fund, would allocate 147 trillion JPY to its Asset Management Division at an interest rate. The Asset Management Division then would loan part of that asset (around 27 trillion JPY) to Welfare Pension Organizations and the Welfare Pension Organizations would consign to private asset management companies to manage the money. However, this fund management model is inefficient because the Welfare Pension Organization is the only one who consigns and invests with the private asset management companies thus only a small part of the total Reserve Fund asset is allocated and invested in the market while the majority of the asset remains unused. Inefficient allocation of the Japanese Reserve Fund is detrimental to the Japanese economy and society as the total Japanese Population decreases. The decrease in total Japanese population means increase in elderly and retirement and decrease in working class. If the Japanese Reserve Fund is not efficiently invested then Japan will have less money to support its elderly population, thus a more efficient model is needed to manage the reserve funds.

After the year 2000, Japanese Government Pension Investment Fund is established to eliminate that extra step and promote direct self-operation; however it didn’t become an independent unit until April of 2006. Through this new model, Japan’s Minister of Health, Labor and Welfare can now directly allocate its Reserve fund through GPIF in return for a 6 trillion payment cost. Then the new GPIF would consign with Private Asset Management Companies directly, thus avoids inefficiency and other public pension schemes. On the side note interest owed previously to the Japan Minister of Health, Labor and Welfare in the old model was paid off in year 2008 and interest owed to the Ex Asset Management Division was paid off in year 2010.

- GPIF Transition

-

After GPIF was established, total Reserve Fund asset allocated to the market increased tremendously. As a result Government Pension Reserve increased, underwriting of FILP bond decreased, interest to fiscal loan fund decreased, and market investment through loans borrowed from fiscal loan fund decreased.

- Government Pension Investment Fund Model Part 1

-

GPIF was established as an independent administrative institution with the mission of managing and investing the Reserve Funds on behalf of Japan’s Minister of Health labor, and Welfare, and taking over all the responsibilities from the old model. Its main purpose is to gain public trust, avoid public pension schemes, increase fund investment efficiency.

GPIF is governed and monitored directly by Minster of Health, Labor and Welfare and it’s managed in a strict way described as follows. First the Minister of Health, Labor and Welfare will set Mid-term objectives (every 5 year) to GPIF. After the objectives are given, the president of GPIF has to create a midterm objective plan for the asset investments for the Minister of Health, Labor and Welfare to review. They will evaluate on GPIF’s operation performance through 2 periods and command for improvements if needed. 2006-2009 is the first evaluation period and 2010-2014 is the second evaluation period. Do note that the Minister of Health, Labor and Welfare has the power to appoint or dismiss the president of GPIF therefore the president of GPIF has to be active.

- Government Pension Investment Fund Model Part 2

-

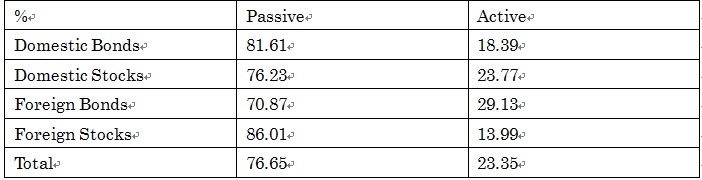

The current mid-term 5 year objective plan includes portfolio based investments that contains mixtures of bonds and companies, and they are selected based on their credit risk management rating and passive operating center. The management intuitions are reviewed and selected through screenings. They are evaluated and screen on in many different aspects such as their balance of assets managed, past performance, company goal and management, asset allocation, exercise of shareholder voting rights, management fees etc. Monthly report, monthly goal, fiscal report and other important evaluation data will also be included in the screening. GPIF has a strict procedure for screening aligned with its well organized internal organization breakdown. Do keep in mind that all GPIF activities are monitored directly by Japan’s Minister of Health, Labor and welfare. ( Please visit the GPIF website directly for more detail on its organization breakdown.)

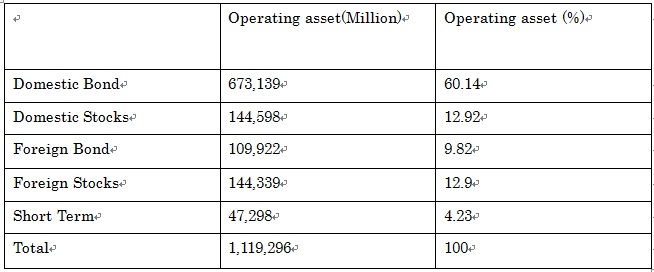

GPIF’s fund management profile as of 2012 March

Private Management Passive Management Active Management Domestic Bond 3 Funds 5 companies 8 funds 9 companies 10 funds Domestic Stocks - 6 companies 7 funds 12 companies 19 funds Foreign Bonds - 6 companies 6 funds 7 companies 7 funds Foreign Stocks - 6 companies 6 funds 12 companies 13 funds

- GPIF Goal and Practive Summary (2010-2014)

-

1) Diversified Investment and Risk Management: GPIF uses diversified investment for risk reduction and efficient management. 2) Portfolio- based investment: Based on the Employee’s Pension Insurance Act and other laws, Reserve Funds must be managed safely and efficiently from a long-term perspective, thus portfolios-based investments are diversified and are selected on the ratio below.

3) Ensuring Benchmark Return: GPIF is trying to ensure the rate of return for every year, every fund, and every investment they are responsible for. 4) Investment Strategies: GPIF investment strategy centers on passive investment due to difficulty to predict the market in long term. Passive strategy is used to secure returns that are in line with the market average while active strategy is used to surpass market average. 5) Exercise of Voting Rights: In order to take appropriate measure for maximizing the long term profits for shareholders, GPIF itself does not exercise voting rights for monitor reasons. Instead, GPIF entrust an external managers to exercise this privilege but under a specific guideline. . 6) Market Consideration: GPIF does not want to make any impact on the market for conservative reasons. Diversified investment strategy is used to reduce risk and increase efficiency of the market. 7) Ensuring Liquidity for pension benefit payment: GPIF ensure liquidity necessary for pension benefit payments in view of the expected path of the pension financing and cash flow, and conducts efficient cash management. 8) Ensuring Professional Types: GPIF ensures high professionalism and high intelligence management foundation providing and targeting only the most accurate and efficient information and investments. 9) Efficiently Operating: GPIF is planning to cut operation cost. Regular management fee: -15% or above Operating cost: -5% or moreTarget Allocation Permissible range of deviation Domestic Bonds 67% +/- 8% Domestic Stocks 11% +/- 6% International Bonds 8% +/- 5% International Stocks 9% +/- 5% Short-Term Assets 5% -

- Selected Asset Management Institution Structures

-

- GPIF Investment Breakdown (as of end of 2012)

-

GPIF was established as an independent administrative institution with the mission of managing and investing the Reserve Funds on behalf of Japan’s Minister of Health labor, and Welfare, and taking over all the responsibilities from the old model. Its main purpose is to gain public trust, avoid public pension schemes, increase fund investment efficiency.

GPIF is governed and monitored directly by Minster of Health, Labor and Welfare and it’s managed in a strict way described as follows. First the Minister of Health, Labor and Welfare will set Mid-term objectives (every 5 year) to GPIF. After the objectives are given, the president of GPIF has to create a midterm objective plan for the asset investments for the Minister of Health, Labor and Welfare to review. They will evaluate on GPIF’s operation performance through 2 periods and command for improvements if needed. 2006-2009 is the first evaluation period and 2010-2014 is the second evaluation period. Do note that the Minister of Health, Labor and Welfare has the power to appoint or dismiss the president of GPIF therefore the president of GPIF has to be active.