1) Slow growth in domestic market

Japan’s growth rate in the past 10 years has been averaging in between 0-2 % range, with negative 4 % being the lowest in 2009 after the Lehman shock (according to IMF data). With the aging population and declining working-age population problem in Japan, economic researchers estimates Japan’s potential growth rate no more than 1%. Since the election of current Japan Prime Minister, Abe, various tactics and reforms have been used to push for higher growth. His aggressive policy on the economy has been known as ‘Abenomics’. Bank of Japan has set to increase inflation to 2 % from the previous negative deflation times. However, as short term outlook for Japan looking positive, outlook for long term growth is limited by its domestic factors (i.e. population and limited resources).

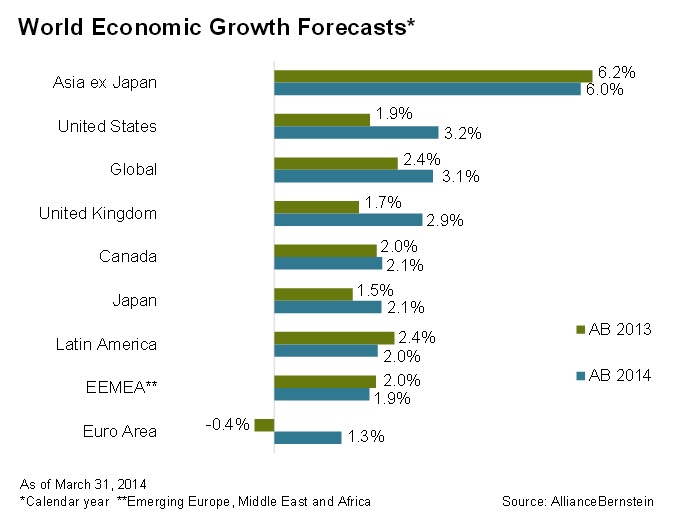

Compare with global economic growth, the outlook on Asia (excluding Japan) still remains the highest with 6.0% forecast for 2014, US with 3.2% forecast, and UK 2.9%.(according to Alliance Bernstein 2014 Global Economic Outlook report).

2) Domestic Return vs Foreign Return

Global Pension Investment Funds (GPIF), Japan’s biggest pension fund and also one of the world’s largest pension funds with JPY 130 trillion assets under management, reported -0.14% domestic bond return at the end of Q3 2013 while invested 55.22% more than half of their assets into the domestic bond market. Foreign bond return was recorded at 14.34% with 10.6% asset allocation. The current 30 year yield by the Japan Government bond is 1.68% and only 0.58% for 10 year yield. Compare with the world US 10 year yield 2.52%, UK 2.61%, Japan has the largest investment in the most unprofitable conservative investment in the world.

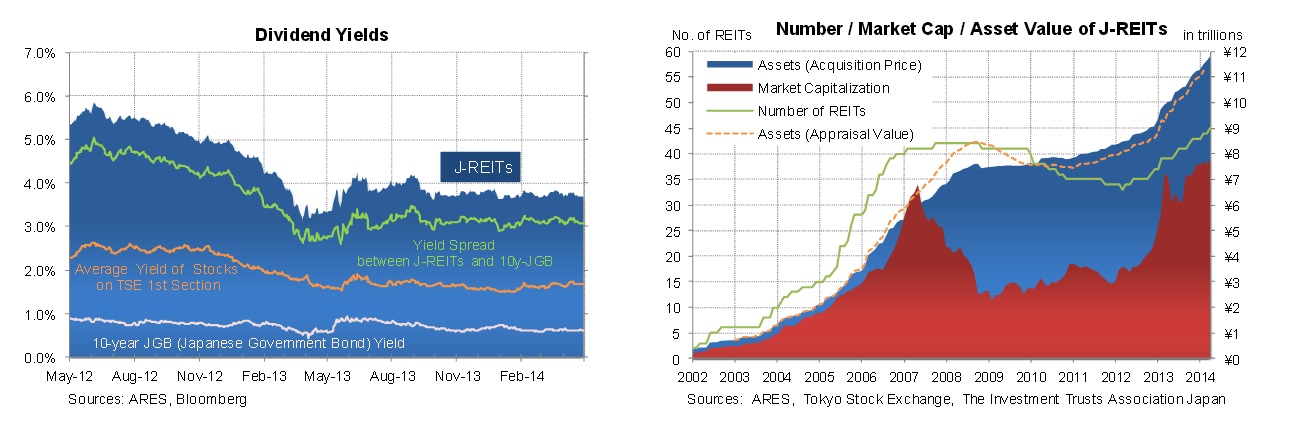

On the other hand J-REIT raised record of $3.6B in equity in 2013 and invested $8.4B the highest volume since 2001. However, the problem for such surge in Japan’s domestic real estate market is because the supply of property investment cannot match with market demand, as majority of the investments are focused on central locations of big cities and drive property price up.

3) J-REIT’s movement towards oversea assets

J-REIT hit new high in 2013 with outstanding performance since 2009. However, when look at the average dividend yield of J-REIT; we see a decreasing dividend rate trend implying cap rate decreasing. Asset acquisition price reached a new high with rental yields becoming stable. With limited upsides for capital gain in domestic market, around 67% of all acquisitions are placed in Tokyo area and 12% are within the central 5 wards of Tokyo in 2013, the concentration of real estate acquisition puts domestic market at its capacity. Talks of J-REIT investing into oversea has been discussed reportedly. Government official has recently reformed J-REIT regulations to strengthen investor confident and push for J-REIT’s investing overseas.

On the side note, most of the Japanese institutions are currently investing in J-REIT. If J-REIT aggressively invests in oversea assets, it implies that Japanese institutions are also investing into oversea assets indirectly. What can be other reasons to not invest in oversea assets directly?

4) Diversification

Diversification is the most important component of reaching long-range financial goals while minimizing risk. Investments in global real estate provide a steady flow of income with equity upside to hedge against inflation, currency change, and other unanticipated economic changes. Traditionally, Japanese institutions only invest domestic market; if so, diversification adds one more reason for them to invest in oversea assets.

5) Business Expansion

Japan has preserved its way of doing business for many years. The culture difference not only made oversea expansion difficult for the Japanese companies, and also Japan expansion difficult for the foreign companies; one of the main reason why many companies choose to work with a local partner when going into new markets, it reduces the risk of investment. Japan institutional market has limited number of experienced fund managers with oversea knowledge and investment experience. Many big-firms are realizing the problem and began research of foreign institution’s investment strategy, hire foreign fund managers, and analyze the opportunities. Japan’s domestic financial institutions are trying to expand their service globally. Their expansion will provide convenience to their domestic clients to go oversea. In addition, some top-tier Japanese real estate companies, construction companies, and developers such as Mitsubishi Estate and Mitsui Fudosan are re-starting their international investments. The trend of investing oversea will soon spread throughout the market, as second-tier institutional investors will also follow the movement.

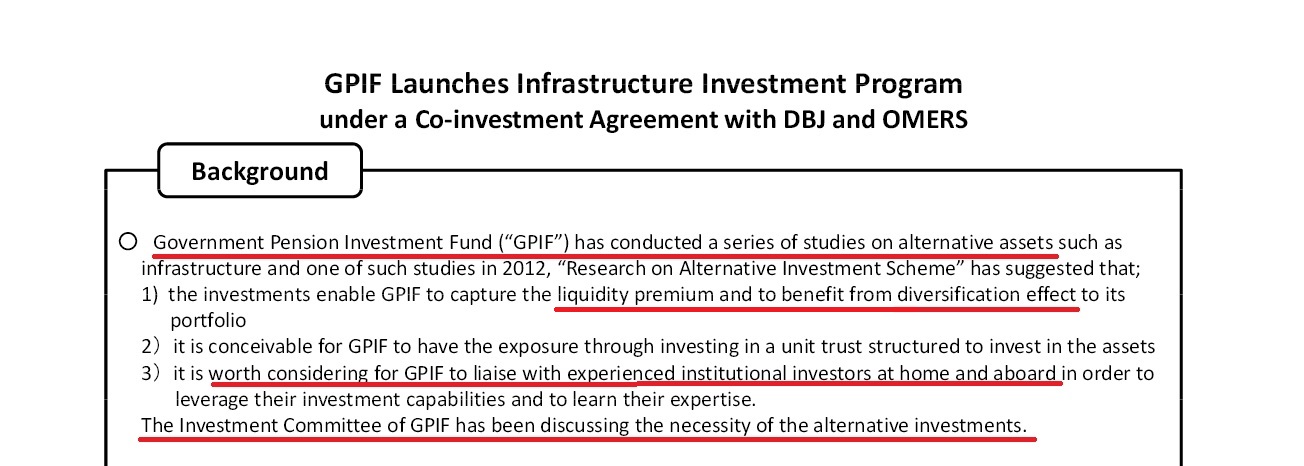

6) GPIF launches infrastructure investment program a hint for the need of alternative asset investment? Here are the highlights

Japanese institutions are not big investors low liquidity assets and have been avoiding investing due to its long-term investment nature. As GPIF finds liquidity premium in infrastructure investment, investment in real estate will be just a matter of time as the biggest investor in the market is taking a lead in investing into these assets. Like infrastructure, real estate assets are also considered as liquidity premium assets as its investment nature tend to be long-term.

7) Abenomics

Over the past year, Japan’s economy surged with Prime Minister Abe’s aggressive policy reforms known as the Abenomics. The surge has shifted Japan’s five year straight deflation to 2.13% inflation, with over 3% growth rate estimated in 2013. The short-term outlook on Japan’s market seems to be promising with Abenomic. Since GPIF reform is also included in Prime Minister Abe’s plan, investment in oversea real estate will happen sooner than expected. GPIF already started sell-off in its domestic bond assets, indicating that they are on the move to invest in long-term inflation sensitivity assets. Nomura Holdings Inc. forecasts a potential $200B investment in foreign assets and predicts more domestic bond sell-off over the 12-18month.