- Portfolios for global funds

-

Data shows that Japan funds goes mainly to fixed income compare to most developed countries, equity as second, and least in Real Estates.CalPERS (USA) 2012 ADIA (UAE) 2012 Equities 49% Equities 46 - 70% Fixed Income 18% Fixed Income 10 - 20% Private Equity 14% Alternatives 5 - 10% Real Estate 9% Real Estate 5 - 10% Others 6% Credit 5 - 10% Absolute Return 2% Private Equity 2 - 8% Infrastructure 1% Infrastructure 1 - 5% GIC (Singapore) 2011 Yale University (US) 2011 Equities 49% Private Equity 34% Fixed Income 22% Real Estate 20% Real Estate 10% Absolute Return 17% Private Equity 10% Equities 16% Absolute Return 3% Natural Resource 9% Natural Resource 3% Fixed Income 4% CPPIB (Canada) 2012 British Telecom Pension (UK) 2011 Equities 34% Equities 24.10% Fixed Income 32.70% Fixed Income 22.00% Private Equity 16.90% Alternatives 21.90% Real Estate 10.70% Inflation Linked 20.60% Infrastructure 5.70% Property 11.40% PFA (Japan) 2012 Equities 39.80% Fixed Income 59.50% Real Estate (& Others) 0.70%

- Asset Allocation to Real Estate

-

If we only focus on the asset allocation in Real Estate worldwide, we find that Japan has the lowest percentage in its real estate sector while average funding for real estate in developed countries are above 10%.Type AUM(billion /USD) Allocation to Real Estate Yale University (US) 2011 Endowment 19.4 20% British Telecom Pension (UK) 2011 Pension 56.7 11.40% CPPIB (Canada) 2012 Pension 160 11% GIC (Singapore) 2011 SWF 247.5 10% CalPERS (USA) 2012 Pension 238.4 9% ADIA (UAE) 2012 SWF 627 5 - 10% PFA (Japan) 2012 Pension 122 0.70%

to view a graph, please click here

- PFA Pension Fund Association

-

“PFA” Pension Funds Association (Japan)

Of the 9.7545 trillion yen capital assets, investment for Real Estate and alternatives summed up to less than 1%, far behind other developed countries in the world. Growing trend and demand lead to investments in alternatives and real estate asset.Investment Portfolio as of Mar 2012 Equities 39.80% Fixed Income 59.50% Real Estate & others 0.70%

to view a graph, please click here

- Strong Potential Investment Power

-

Although China has the highest GDP in Asia, Japan has a tremendously higher GDP per Population than China and it is placed second in GDP growth in Asia. With only .07% asset allocation in real estate, there is no doubt that Japanese have strong potential investment power in real estate.Country Population (in mil)GDP(in USD mil) Japan 128 5,869,000 China

1348 7,298,000 Singapore

5 260,000 Malaysia

28 279,000 Hong Kong

7 243,000 India

1206 1,676,000 Indonesia 241 846,000

to view chart, please click hereSource: IMF World Economic Outlook, April 2012

- Public Pension Fund Reserve

-

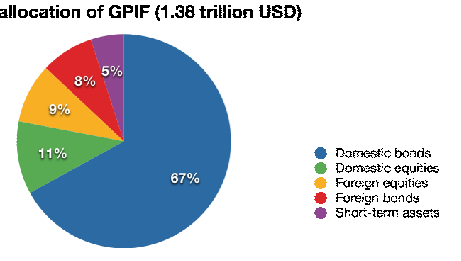

Japan’s Government Pension Investment Fund (GPIF) has generally been a conservative investor. Bonds and stocks make up the majority of their portfolio. Recently GPIF announced its plan to increase alternative assets, including private equity, infrastructure and real estate into its investment strategy.

Assets in public pension funds as of 2009, please click here

- Private Pension Fund Sector

-

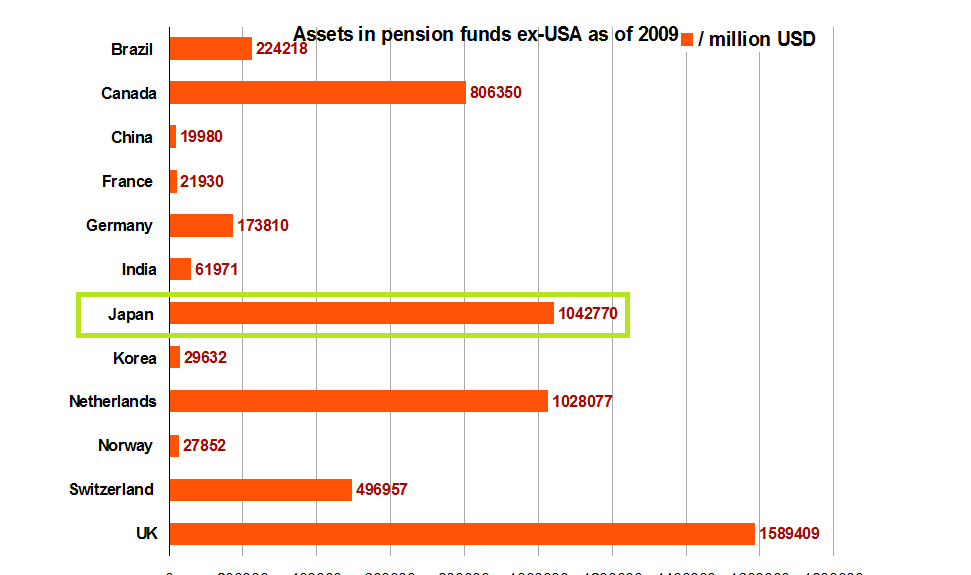

Source: OECD “Assets in private pension funds and public pension reserves”Japan has the second largest asset in pension funds compare to rest of the world as of 2009, which implies Japan is a wealthy investor globally. However, current return of Japanese pension funds investments is disappointing as we go more in depth on Japan's allocation of their funds.

- Portfolio Allocation of Japanese Pension Funds (Private Funds)

-

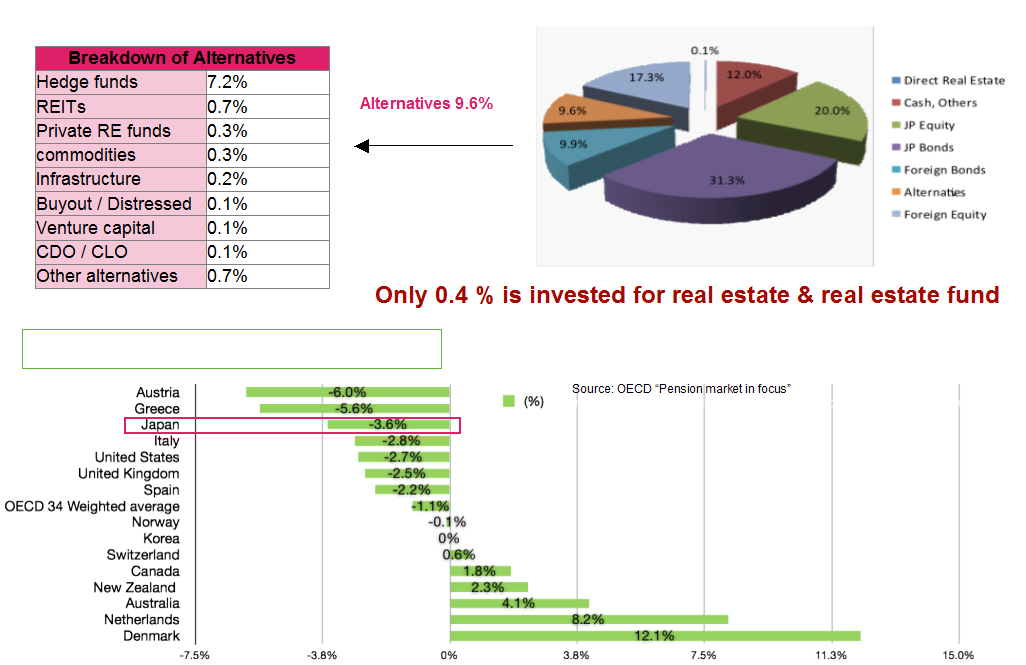

Among all the allocations, only 9.6% of total Japanese Pension Funds are invested in alternative investments, and only 0.4% of that goes in real estate, thus proves the lack of investors/investments in real estate sector. In addition, Japan has a negative 3.6% loss in its total pension fund, while having the world's second largest pension funds asset. This indicates that Japan's current investment plans is flawed and thus we need to find alternative investments and perhaps in real estate.

Among all the allocations, only 9.6% of total Japanese Pension Funds are invested in alternative investments, and only 0.4% of that goes in real estate, thus proves the lack of investors/investments in real estate sector. In addition, Japan has a negative 3.6% loss in its total pension fund, while having the world's second largest pension funds asset. This indicates that Japan's current investment plans is flawed and thus we need to find alternative investments and perhaps in real estate.

- P&L for Japanese Corporate Pension Funds

-

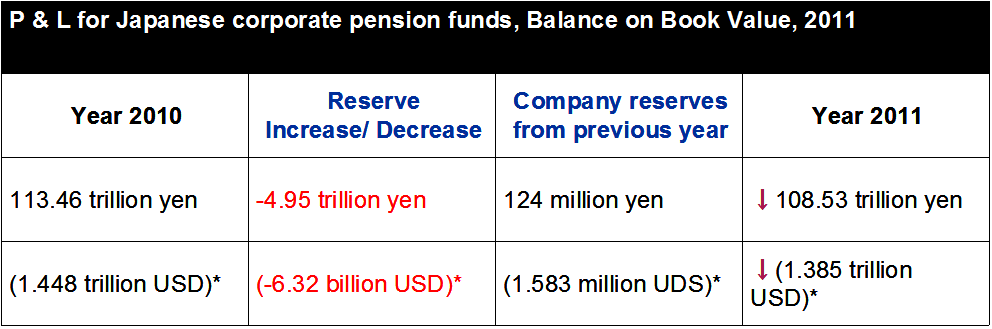

Japanese Pension Funds have been suffering loss given the bearish economic market and conservative portfolios, need higher return

- Too many reasons for more alternative investment by Japanese investors

-

Japanese Yen continue to rise as USD falls

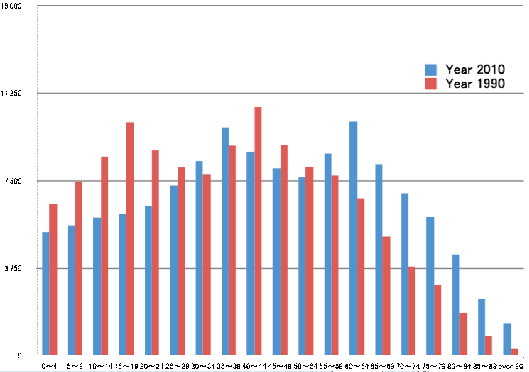

The well-known aging population in Japan, as Japanese population decreases

Through comparison of aging distribution between 1990 to 2010, aging and decreasing in population contributes to the low return in domestic market *due to the decrease in work force. In addition, as the JPY continue to rise, driving the cost of domestic investments to increase, more and more pensions and institutional investors are shifting towards alternative investments globally.

- Our Coverage

-

Strong coverage of global real estate market:

As a top boutique advisory for cross boarder real estate investment with Japan, we have very broad and deep knowledge and experience. We have served for many global investors such as Asian top family offices, private

banks, global real estate fund, insurance companies, international REITs, Japanese real estate

companies and many more, for their real estate investment both into and out from Japan.

Strong coverage of Japanese LP market:

Japanese LP industry has been very conservative, and the market is dominated by passive parties where holdings are

established in interest from regulators. Being away from such traditional business practice with

relationship that favored sales and the conflicts of interest by Japanese trust banks, we provide prime

global investment chance & information to Japanese LPs without being effected by traditional

Japanese exclusive business practice. This is rare and fairly new but a trustworthy approach to Japanese LPs, and why

we have have the advantage in presence to Japanese LPs.

Several channels to approach to Japanese LP:

Through many types of events that we host, such as organizing PERE Forum: Japan 2012,

private seminar to Japanese pensions, Japan SWF study group and publishing global private

equity real estate market news letter,,,etc.

we have strong access to Japanese LPs with a broader point of view as only one third party

information provider for global private equity real estate market in Japan

- Why Us?

-

Japanese institutional investors investing to real estate & PE fundsTypes of Investors

Our Coverage Insurance Companies more than 20 investors Corporate Pension Funds more than 110 investors Japanese Corporate banks and investment associations more than 20 investors0 Japanese FoFs & Gatekeepers more than 10 investors *Family Office (Japan and Asia) more than 10 investors *Private banks (Japan and Asia) more than 10 investors Our experienced & in depth niche service lines to maintain strong relationship with Japanese LP- News letter distribution on global real estate & alternatives to limited & qualified Japanese LPs- Organizing seminars on global RE, PE, infrastructure investment for Japanese LPs- Providing researches on global SWF / endowments / pensions strategiesWe are the only professional party who specialize and provide global institutional real estate investment information to Japanese LPs