Survey from Asterisk’s US real estate investment seminar highlights what Japanese investors expects from the global real estate investment

Monday, 24th October 2016

Asterisk’s seminar for Japanese institutional investors on US real estate investment was held on Oct. 4. The purpose of the seminar was to provide more global real estate and infrastructure investment insights to Japanese institutional investors. <https://japanplacementagent.com/en/event/asterisks-seminar-for-japanese-institutional-investors-on-us-real-estate-investment/>

The survey was created to understand interest among attendees, Japanese institutional investors, regarding the global investments. Based on the survey we conducted, we found relevant responses to suggest the specific areas that those Japanese investors are interested in investing global real estate.

Based on the questionnaire responses, Asterisk found a number of key points to evaluate Japanese investors’ preferences for global investment.

The seminar was for top Japanese qualified institutional investors with attendee limits. 55 of attendees included: public pension funds, insurance companies, industry central banks, corporate pension funds, asset management, FoFs, major banks, regional banks, principal investment divisions of general business companies, REITs and trust banks.

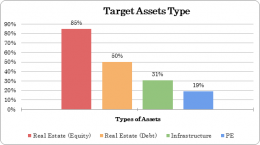

Target Asset Type : 85% of respondents are interested in real estate equity investment, as well as high interest in real estate debt investment (50%). The other targets were for infrastructure (30%) and for PE (20%). This indicates that real estate equity might be seen very different asset from other alternative assets for them.

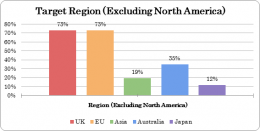

Target Region (Excluding North America) : Although this seminar focused on the US real estate, respondents showed high interest for UK and EU real estate as a target region, and about ⅓ of respondents are interested in Australia real estate. About ⅕ responded Asia and very few responses for Japan. This result may imply that Japanese investors had enough domestic real estate investment and they are now starting to focus more on looking at global real estate as an independent asset class.

Preferred Investment Strategy : The majority of respondents are interested in core/core-plus strategy, and a half of them are interested in value-add strategy. Much lower interest for opportunistic and secondary, but it is still remarkable that about 20% of them are interested in these strategies.

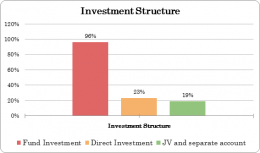

Investment Structure : Although some large investors showed their interest in direct investment and JV / Separate Account, the majority of them were interested in investment through funds. This result reveals that their investment approach for outbound real estate has changed from the last outbound real estate investment wave by Japanese investors in 1980s – 1990s.

By looking at the key points which we found from the collected survey, it gives a big picture of Japan’s trend for outbound investment. It seems that the interest of global real estate investment by Japanese investors are growing and has now become a fact. Therefore, they are seeking for such an informative seminar like this, where they can receive information for their investment decisions.

Yet, there is still a large gap of mutual understanding, especially in necessary information between overseas fund managers and Japanese investors.

Asterisk provides tailored advice, consultancy, and capital placement service to the global fund manager and Japanese investors, as a bridge between overseas market and Japanese investors.

Asterisk’s upcoming seminars for Japanese institutional investors

Australia & ASEAN real estate investment (2017 February)

- “Diversification vs Concentration in growing markets” and “Real Estate, asset to secure value and bless with ASEAN growth”

- “Long-term investment in Australia, the country with contrasting characteristics to the Japanese economy”

UK real estate investment (2016 November or 2017 January)

- “The momentum & opportunities in post-Brexit”

EU real estate investment (2016 November or 2017 January)

- “EU’s real estate market cycle, and what are the opportunities for each investment strategies? ”

_________________________________

For further details about this newsletter and our services, please contact: Yukihiko Ito (yuki@asteriskrealty.jp) / Yokaze (yokaze@asteriskrealty.jp)

To view our past newsletters, please visit our website : https://japanplacementagent.com/en/

About Asterisk Realty & Placement Agency

Asterisk is a private fund placement agency for global alternative in Japan. Through our unique and extensive network of Japanese investors, we support global fund managers in accessing Japanese and Asian institutional investors (pensions, financial institutions, real estate developers, other business companies, etc.).

We provide access and strategies for overseas fund managers to bridge the gap between them and Japanese investors.

Asterisk Inc.,

3-29 Kioicho Gluckheim Suite 2003 , Chiyoda-ku , Tokyo , Japan

Telephone: 03-3263-9909

Email : info@japanplacementagent.com

Website : https://japanplacementagent.com/en/

Type II Financial Instruments Business License The Kanto finance Bureau No.2577

Real Estate License / Governor of Tokyo (2) No.89094