GPIF Sets Two Indices for its ESG Benchmark

Asterisk to hold an ESG real estate investment symposium on October 24th in Tokyo. Thursday, October 4t […]

Entering the Japanese Hotel Market

How international investors and hospitality operators can get into the locally dominated Japan market Thursday […]

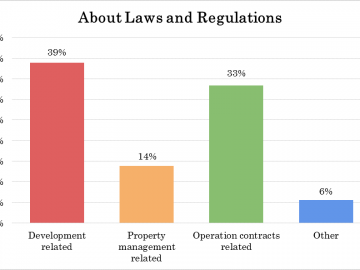

Survey: Japanese institutional investors for global real estate investment – 2017 March

Survey from Asterisk’s EU & UK real estate investment seminar highlights what Japanese investors expects f […]

Japanese institutional investors with total asset of over 10 trillion USD are eyeing global real estate investment

With significant increase of demand, now majority of Japanese investors are considering global real e […]

Osaka heads out for Japan’s casino development, aiming for No.1 in the country

Osaka, the front-runner for Japan’s casino development, revealed economic assessment show enormous prosperity […]

Japanese Investors Survey: Investment & Development of Luxury Hotels and Branded Residences

Survey from Asterisk’s hospitality investment and development seminar reveals Japan’s upsurging interest in lu […]

Japanese insurers suffer from negative interest rates, strengthening their focus on alternative investment

Interim financial results of Japan’s top 9 life insurance companies including Japan Post Insurance reveals the […]

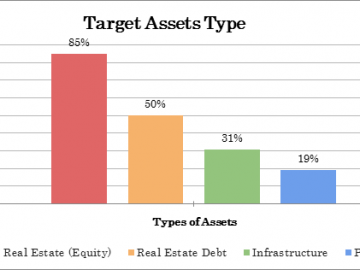

Japanese Investors Survey: Japanese institutional investors for global real estate investment

Survey from Asterisk’s US real estate investment seminar highlights what Japanese investors expects from the g […]

Pension Fund Association 2012 Performance and Investment Planning

Pension Fund Association is one the largest pension funds in Japan with total of 10.7 Trillion JPY assets und […]

- Asset Allocation Overview

- Investment Return Overview

- Investment Strategy Overview

- Policy in Alternative Assets

- Selection and Evaluation of Investment Managers

Global Pension Fund Performance Comparison

*Data of this report are based on the most recent official performance report released by each Fund. For more […]

- Caisse de depot et placement du Quebec

- CPPIB

- ADIA

- Yale Endowment

- Harvard Management Company

- Government Pension Global Fund (Norway)

- GPIF Japan

- CalPERS

About Government Pension Investment Fund (GPIF)

As of quarter 3 of fiscal 2012, GPIF reported an increase in total investment with a 4.83% rate of return, 5,1 […]

- GPIF Background History

- GPIF Transition

- Government Pension Investment Fund Model Part 1

- Government Pension Investment Fund Model Part 2

- GPIF Goal and Practive Summary (2010-2014)

- Selected Asset Management Institution Structures

- GAIF Overall Performance

- GPIF Substantial Investment Yield

- GPIF Investment Breakdown (as of end of 2012)

Asset Management for Japanese Employee Pension Fund Report

Note: The Japanese Employee Pension Fund Report is analyzed based on the Fund Earning Reports that were submit […]

- Allocation of Total Japanese Employee Pension Fund (as of March 2012)

- Types of Management Accounts within Employee Pension Funds (as of March 2012)

- Number of Japanese Employee Pension Fund under Other Investments for the Past 5 year

- Japanese Employee Pension Fund Asset Allocations

- Japanese Pension Fund’s Investment Yield for the Past 5 Years (%)

Survey About Japanese Pension Funds to Global Real Estate Investment

In spite of strong investment power, Japanese public and private pension funds are allocating less than 1% of their portfolios to real estate. What is a fact? and the survey is focus on strong potential of Japanese pension funds to global real estate investment.

- Portfolios for global funds

- Asset Allocation to Real Estate

- PFA Pension Fund Association

- Strong Potential Investment Power

- Public Pension Fund Reserve

- Private Pension Fund Sector

- Portfolio Allocation of Japanese Pension Funds (Private Funds)

- P&L for Japanese Corporate Pension Funds

- Too many reasons for more alternative investment by Japanese investors

- Our Coverage

- Why Us?