GPIF revealed its investment activities in FY 2018, showing consistent progress in real estate investments and indicating its directions forward.

July 10th, 2019

Last week, GPIF released its 2018 annual report and review of its overseas investment progress in alternative assets and real estate assets over the last year. Total AUM of GPIF is 159 Trillion JPY (1.46 Trillion USD) as of Mar 2019.

ACCELERATED INVESTMENT PROGRESS IN ALTERNATIVE ASSETS

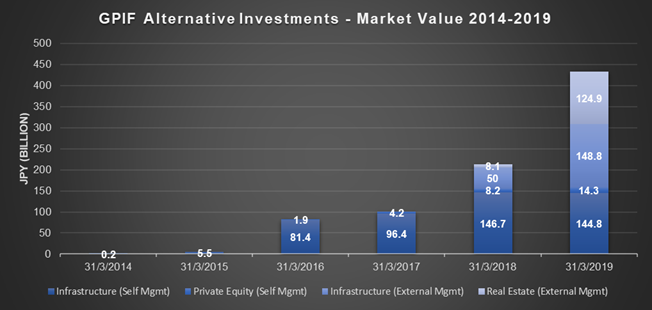

GPIF Historical Market Value of Alternative Investments 2014 -2019 (Source: GPIF Annual Report Japanese)

Over the last year, GPIF’s investments in alternative asset class has more than doubled, reaching 432.7 Bn JPY (3.97 Bn USD) as of March 2019 compared to 213 Bn JPY (1.96 Bn USD) as of March 2018. However, as a percentage, it is still only 0.26% of its total AUM, which is far below their target allocation of 5% in alternative investments that they can invest up to. Specifically for real estate sector, as we see from the above chart, GPIF didn’t really start actively investing in real estate since 2017, and its real estate investments in fiscal year of 2018 is over 1 Bn USD, more than 15 times of its real estate investment volume in 2017. We can see from the figures published by GPIF, they are just getting started to invest more in alternative assets, particularly for real estate, and we anticipate that their speed will be accelerated with more investment strategies and structures allowed in their policy in the near future.

REAL ESTATE: APPOINTMENT OF MORE GATEKEEPERS & FOF MANAGERS

For real estate, GPIF currently focuses on core strategy in real estate equity and debt through gatekeepers and FoF managers. For overseas real estate investments, so far GPIF has appointed Asset Management One as gatekeeper and CBRE Global Investment Partners as FoF manager for Global Core Strategy since September 2018. Total AUM of overseas real estate assets managed by the two fund managers is 54.5 Bn JPY (500 Mn USD) as of March 2019. GPIF will continue to select more FoF managers in the future to diversify their portfolio.

Additionally, GPIF is changing their investment regulations, which allows them to invest in limited partnerships, meaning they will be able to do more investments in form of JV in the near future once the change is taking effect.

As GPIF gets more channels & methods and open to more new investment strategies, we expect that their progress in alternative and real estate investments in overseas markets will also be accelerated in the second half of 2019 and 2020.

ESG AS AN ON-GOING KEY THEME FOR GPIF

GPIF also spends a decent portion in the annual review discussing about its approach and progress in ESG investments, we can see that ESG is one of the most important factors in their investment strategies and decisions and expect them to continue to make more efforts on ESG.

The term ESG appeared over 100 times in their latest Japanese annual report.

CONCLUSION

We expect that GPIF will continue to accelerate its investments in alternative assets under faster pace, and look into more strategies and approaches in the coming years.

ESG will continue to be essential and one of the most important considerations in GPIF’s future investments in alternative assets and real estate.

To review more on our past articles and events, please find the link below:

https://japanplacementagent.com/en/

For further details about our newsletter and our services, please contact: info@asteriskrealty.jp.

About Asterisk Realty & Placement Agency

Asterisk is a private fund placement agency for global alternative in Japan. Through our unique and extensive network of Japanese investors, we support global fund managers in accessing Japanese and Asian institutional investors (pensions, financial institutions, real estate developers, other business companies, etc.).

We provide access and strategies for overseas fund managers to bridge the gap between them and Japanese investors.

Asterisk Inc.

3-29 Kioicho Gluckheim Suite 2003 , Chiyoda-ku , Tokyo , Japan

Telephone: 03-3263-9909

Email : info@japanplacementagent.com

Website : https://japanplacementagent.com/en/